It's time for crypto projects to evolve or die

Winter has come to the crypto markets, with both projects and the wider crypto community feeling the pain. Right now, many are scratching their heads wondering how some crypto projects have gone from raising tens of millions of dollars last year to standing on the edge of financial ruin. One thing is for sure, there need to be some serious changes in the crypto market and how projects conduct themselves. The future of cryptocurrency is at stake and it would be a true loss to innovation if this space were to echo away into obscurity.

How cold is it out there?

In a nutshell, ice cold. Bitcoin itself is down over 80% from its all-time-high and many altcoins are down more than 95%. Unless you have been living under a rock, you’ll know that the euphoria of Christmas 2017 has all but died. We don’t hear people uttering the words ‘When moon?’ anymore. Instead, this has been replaced with ‘when homeless?’ and ‘when McDonalds?’

Throughout the year, cryptocurrency backers have had to put up with refreshing their Delta apps every day and coming to terms that the sea of red they see as the new normal. We know it hurts to see your portfolio being decimated. However, what many didn’t expect is that the crypto projects that raised tens of millions just a year before are now facing financial difficulty.

Don’t know the scale of the difficulties facing the cryptocurrency markets? Let us tell you:

- The crypto social media platform Steemit announced that they laid off 70% of their staff due to “relying on projections of basically a higher bottom for the market and since that’s no longer there”. Although it’s clear that Steem had completely mismanaged their finances, it is brave of the CEO and Founder, Ned Scott, to come out and tell the project’s backers the truth.

- Sirin Labs managed to raise a whopping $158M funding in 2017. Just a year later, CEO Moshe Hogeg announces on Bloomberg that the company can now only cover 6 – 12 months operating costs. What’s even worse is that he went on to reveal that Sirin is now considering abandoning their hardware wallet smartphone and, instead, pivoting to software.

- Igor Artamonov CTO of ETCDEV’s went on Twitter on the 3rd of December 2018 to tell the world how his business couldn’t continue with their development efforts on Ethereum Classic. The reason given was an internal cash-crunch at ETCDEV and current crypto market conditions.

- ConsenSys announced that the company would be laying off 13% of their staff. This came as a shock to many given the companies role in powering a significant portion of Ethereum related software.

All these announcements happened one after the other between late November and early December 2018. You know the crypto winter is a harsh one when you see some of biggest projects and companies in the space coming out and admitting that they are under financial pressure. The worst part of it is that we suspect there are other projects that are experiencing similar or even worse difficulties that have yet to come clean with their communities. Think about it if you were a CEO of a struggling crypto project; you would almost certainly have a strong financial incentive to put off disclosure for as long as possible.

How has this happened?

Sadly, the only reasonable explanation for projects raising 10’s of millions one year and being on the financial brink the next, is that treasury management has been terrible and there is distinct lack of competent CFOs in the space. Few would think that crypto projects would have put themselves in this predicament on purpose. However, it has happened now and the real question is why and what can be done to strengthen crypto projects in the future?

Look at the known wallet addresses for projects that raised funding and ask yourselves if many competent CFOs would have allowed projects to hold so much of a project’s treasury assets in crypto? Ask yourselves how many employee contracts at crypto projects are denominated in Ethereum or Bitcoin? Sure, if these projects all had employee contracts paying people like 3 Ethereum a month, then there is some sort of case to be made. The problem, of course, is if when the contract was entered into that those 3 ETH were worth around $5,000 and the market crashes to $100 per ETH. Do you really think that someone is going to work their socks off for $300 per month when previously they were receiving over sixteen times that amount in USD valuation?

Of course, projects would have extended their runways if crypto prices had increased. The problem partly appears to be that some projects were speculating on the prices of cryptocurrency increasing in 2018.

The next question is concerned with how raised funds were actually spent. The truth is that very few projects in the cryptocurrency markets actually disclose how funds are actually spent. TenX and Nimiq have led the way in terms of publishing transparency reports to tell their communities how funding has actually been spent. Maybe if it were an industry standard for quarterly transparency reports to be published by all crypto projects, then we would have had advanced warning that some were struggling financially.

What’s for sure is that many crypto projects cannot continue to operate as they have in the past. Instead, projects need to evolve and put in place proper treasury management processes and hire good CFOs to ensure that we learn from the lessons of this crypto winter. Without this evolution, we think it’s highly likely that many crypto projects will die.

The opportunity for the cryptocurrency market

The cryptocurrency market is currently at a crossroads. Serious problems have certainly been identified in terms of how crowdfunded money has been used or managed. The opportunity is certainly there for crypto projects to learn from these mistakes and safeguard themselves and their communities in the future. That’s probably of little consolation for the communities of crypto projects who have come forward to reveal that their project is in trouble. However, with the crypto market being in the state it is currently in, do you really believe that a new wave of investors will swoop in and take the cryptocurrency to new all-time-highs?

The truth is that everyone makes mistakes; it’s what you learn from them and how you react that counts. Projects in the cryptocurrency market now have the opportunity to look at what went wrong or learn from the mistakes of others. If this happens, then we think that it will be a lot easier for a new wave of cryptocurrency supports to enter this space and support the innovation that is happening here. We should certainly look to ensure that market conditions never again stifle development and innovation.

One projects loss could be another’s gain

There is little doubt that more people work in the cryptocurrency industry than at any other time in history. Crushing layoffs as we have seen at projects, such as Steem, create a pool of untapped talent. Where will this talent go now? Will it exit the cryptocurrency space entirely or will better-managed crypto projects see the opportunity to expand their talent pools?

Already, some crypto projects are creating new opportunities for the crypto talent pool. As they say; when one door closes another opens.

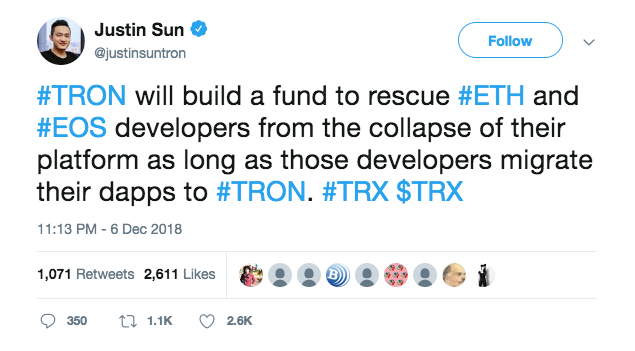

Many of you will already be familiar with Tron and its figurehead, Justin Sun. On the 6th of December, Justin announced that Tron is building a fund to help rescue developers from the collapse of their platforms. Sure, many have seen this as opportunistic. However, at least an alternative is being offered to talent in the crypto space that may have recently been laid off.

Other projects like Nimiq, the first browser-based blockchain, have also recently launched their Community Project Funding initiative. This gives blockchain developers laid off from other projects other options to stay in crypto right now.

Time will tell how these more astutely run projects will fare in the future and if there will be a consolidation of talent in the crypto markets. That could very well be good news for the entire space and allow us to rebound as a market stronger than before.

Conclusion

There is no doubt that both the cryptocurrency market and projects are feeling the pain of the bear market right now. Some crypto projects have certainly succumbed to poor treasury management or failed to identify that a strong CFO has value. Yes, it is a tough time for the cryptocurrency space. However, little will be achieved by projects capitulating and just calling it a day. Instead, the overall cryptocurrency market can rebound stronger than ever before if projects restructure, deploy proper treasury management controls and hire solid CFOs.

The truth is that change may come too late for some crypto projects. However, the crypto community should not be placed in a position where they are blindsided by the news that the crypto project they are supporting is experiencing financial difficulties. Maybe more projects should follow the example set by projects like Nimiq and actually provide their communities with breakdowns on how funds have actually been spent.

The time for change is now. If some crypto projects do not evolve, then it’s likely they will die. Positive changes in the cryptocurrency industry at a project level do bring with it the potential to usher in a new wave of crypto enthusiasts and supporters. That outcome is something we bet that most people in the space want.

There will no doubt be winners and losers amongst crypto project projects in this bear market. The question is which projects will rise up from the ashes and use these tough market conditions to their benefit?

Disclosure: The author holds some NIM in their portfolio and is compensated in a long-term independent consulting capacity by Nimiq. This article must not be construed as investment advice. Always do your own research.