Kiddie Kredit helps kids learn about credit and increase financial literacy

It's never too early to start learning about credit according to Evan Leaphart, founder and CEO at Kiddie Kredit, a startup based in Miami focusing on educating children about credit. Most recently, Kiddie Kredit graduated from the Endeavor Miami accelerator, but has also taken part in the 500 Startups and Miami EdTech accelerators as well.

I had a chance to watch Evan pitch Kiddie Kredit during the Endeavor Miami demo day a little over a month ago and was immediately impressed by his company, pitching skills, and background. Evan has mentored kids and has a strong desire to change the future by educating people with the goal of bringing more economic equality. That's absolutely something I can get behind!

Kiddie Kredit overview

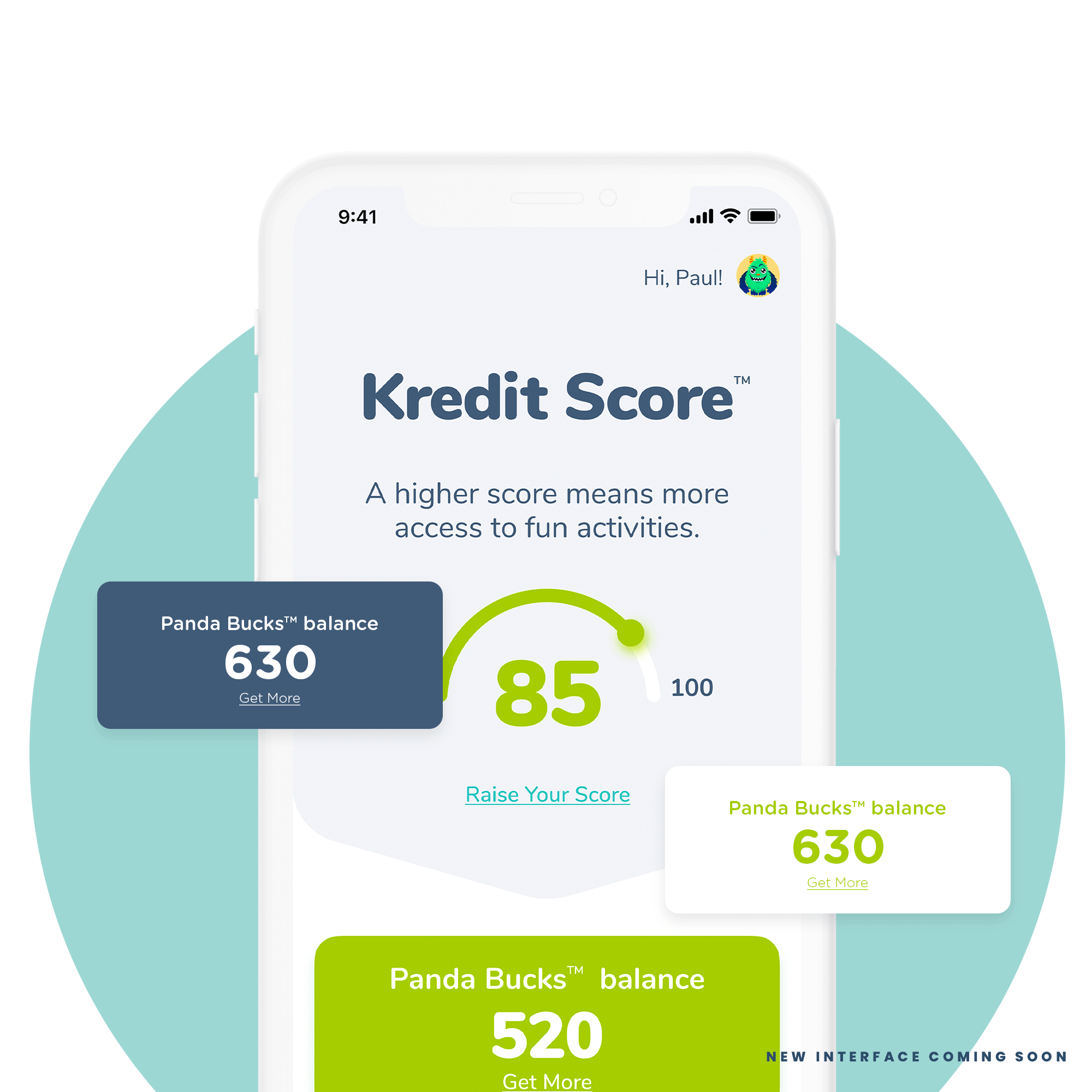

Kiddie Kredit, which Evan founded in 2018 and launched a public beta for in 2019 has been helping parents educate their children about credit scores for a couple of years now. The startup uses an algorithm that informs kids of how well they're doing with their chores or activities around the house, very similar to that of a FICO or Equifax credit score. To be clear though, Kiddie Kredit's Panda Score (what it's called in-app) has no affect on your child's actual credit score. It's designed to be an education platform for kids to understand how credit scores can be affected based on your behavior.

Of course, Evan & Co. have plans to expand the company's offering in the future as well. He sees partnerships with the likes of Visa and Mastercard as a way to help get young adults access to their first credit card. To me, a partnership like this makes absolute sense, you're educating children about credit so building in the ability to leverage your Panda Score into an actual credit card when the time is right seems like a logical step that benefits everyone.

Building awareness

When it comes to building awareness and a user base for the app, Evan knows he has his work cut out for him. Speaking with him, one thing is clear though: he doesn't want to charge the people that need to learn about credit the most, which means he and his team are focusing on a B2B2C business model. This model means working closely with schools and other organizations with lots of parents. At the moment, the subscription cost is $50 per year/per family unit.

In terms of working with schools it's important that the team can approach and win over teachers across the country to champion their app within school districts. Not an easy feat, but after speaking with Evan, if anyone can do it, I think he's the person.

The future

As of now, Kiddie Kredit is in the middle of raising a $1.5MM seed round and will be relelasing version 2.0 shortly. The app is currently available on iOS and is coming (back) to Android soon.

Here's a sneak peek of what's to come: