AI is taking over the crypto world thanks to WatermelonBlock’s partnership with IBM Watson supercomputer

IBM Watson Supercomputer has come a long way since it won “Jeopardy!” in 2011. During its episode, IBM’s Watson computer challenged two “Jeopardy!” Champions and beat them by demonstrating its ability to understand natural language as it gave relevant answers to questions provided. Back then, it was a breakthrough for AI and machine learning but Watson intelligence goes beyond its ability to process information. Watson is unique in its ability to function in a very similar way to the human brain, Watson gets smarter by learning from each interaction with its users and data collection. This uniqueness has allowed IBM to introduce Watson into other industries, starting with healthcare.

In 2012, IBM announced Watson for Oncology, aimed at helping physicians quickly identify key information in a patient’s medical record, surface relevant evidence, and explore treatment options. Since then, IBM Watson has been incorporated into a wide range of industries including retail, law, music, image recognition, hospitality, and even cooking.

Now, IBM Watson is ready to join the crypto wave thanks to its partnership with WatermelonBlock. Using IBM Watson algorithms to analyze big amounts of data, WatermelonBlock aims to provide investors with real-time insights and detailed analysis regarding the market sentiment of top cryptocurrencies and ICOs.

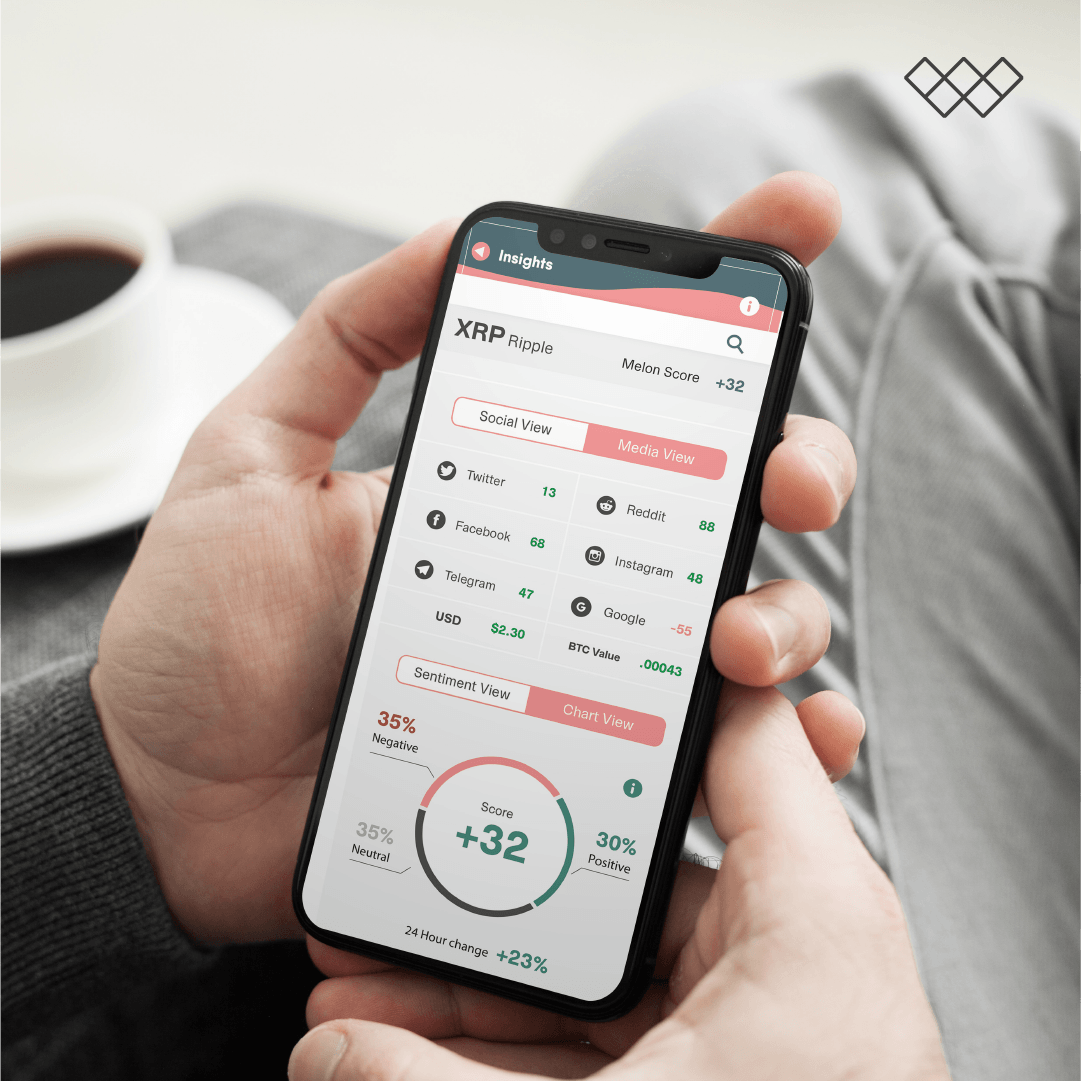

WatermelonBlock understands the importance of market sentiment in the crypto world. Crypto investors are constantly using social media to exchange information and opinions regarding blockchain assets, like cryptocurrencies. By recognizing the influence opinions have within the cryptomarket, WatermelonBlock uses Watson to categorize big data sets according to their social influence and reach to help investors stay on top of investment information in real-time. Then, WatermelonBlock uses its proprietary algorithm, the MelonScore, to compute a percentage and index score for each network.

WatermelonBlock features include the Watermelon Index, MelonScore, Personalized Portfolio and Watermelon Alarm. Each is designed to help investors make more accurate and better informed trading decisions:

- Watermelon Index: Tracks the top 500 cryptocurrencies rated by MelonScore, which is based on world sentiment that is determined by IBM’s Watson.

- MelonScore: Built upon big data sets gathered from social media, blogs, news microsites, and other forms of public forum which indicate how the world is currently feeling about any given currency.

- Watermelon Alarm: Searches for any major change in sentiment within the market, specific coins, and ICOs and lets the user know via push notification.

- Personalized Portfolio: Gives users the ability to store the details of their ICO token holdings and values in one place, neatly formatted.

Those who navigate the confusing world of cryptocurrencies know that the crypto scene is flooded with misleading information and fake news about the market. This is why a trustworthy platform like WatermelonBlock backed by IBM Watson AI computer is a great step forward for both crypto and blockchain legitimation. Nevertheless, the use of a powerful tool like machine learning solely to enhance crypto transactions and traders seems not enough. Although blockchain seems to be a technology that needs to be embraced for long term projects, we can’t say the same about ICOs and crypto trading. According to an article by Fortune, nearly half of 2017’s Cryptocurrency ‘ICO’ projects have already died. We have yet to see what WatermelonBlock has in mind after ‘ICO’ projects are officially dead and crypto trading is over. Maybe, for WatermelonBlock, this is just the first step on the road to transforming the whole trading industry as we know it.