Bulls and Bears is a new game that wants to help you prepare for retirement

Do you know the difference between a stock and a bond? What about the difference between your savings account and a 401(K)? And speaking of that 401(K), when you set it up, how did you have it vested? No idea? Well, you’re not alone, the most recent studies don’t bode well for financial literacy in the US, and the state of economic literacy becomes worse when you talk about millennials and younger people.

One man, Mario Fischel, decided this is just wrong – young people who are just figuring out their finances should know as much as possible so they can set themselves up for success in the future, through setting up sound investments and proper retirement plans. That’s why Fischel created Bulls and Bears, a game dedicated to teaching players of all ages about the financial world around them.

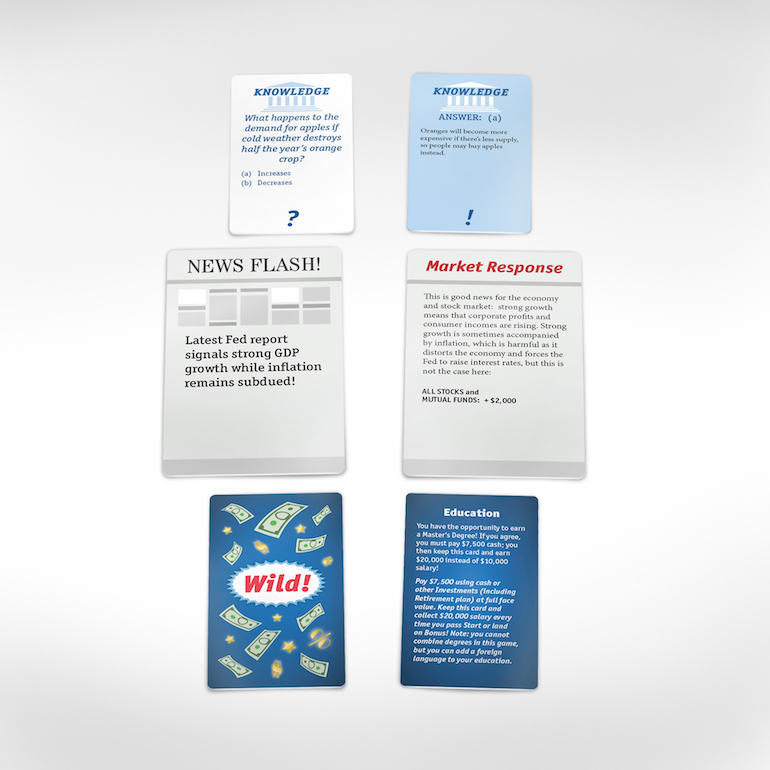

The game takes place on a board, and this progresses the game, but the real financial secret sauce is in the cards. The cards can cover anything from retirement plans to the effects of the Chinese market, and they are also the educational component of the game. The “Knowledge” card deck explains concepts and skills, and then quizzes the players on them with flash-card-like questions such as “How to calculate price-earnings ratios,” “What’s an ETF?”, “What’s the difference between real and nominal interest rates?” The players compete against each other in answering the financial trivia questions.

In addition to the knowledge cards are two other decks that imitate life: the uncertainties and the complexities of it. News Flash cards teach players how to respond to the events, in politics and in economics, that affect us all. When “Congress cuts taxes,” “Fed launches quantitative easing,” “President slaps tariffs on imports from China,” do you make your money and investment decisions differently? Are you even aware of how these events and laws affect your daily life? Bulls and Bears forces players to deal with these situations, assess the impact of each event, and buy or sell assets accordingly. The game then reveals the real market response and the players either earn or lose money.

The third and final set of cards teach the most important lesson of all: that life is unpredictable. Since unpredictability is what often tosses a wrench into even the best-laid financial plans, it’s important to teach young people to expect the unexpected and rise to the challenge of hitting life’s curveballs. It’s equally important to recognize good opportunities as they arise, and take full advantage of them. Saving and investing for the future is one of the most important habits that many millennials sadly lack. The Bulls and Bears Wild Cards present opportunities and crises alike, and players are expected to deal and change their financial plans to fit the new reality.

By teaching kids and adults to manage their money in the face of changing technologies, economics and politics, Bulls and Bears challenges a situation that not many have the guts to face: that the current system and culture are failing us as citizens of the world and failing our children as future members of society. What’s needed is a revolution in how we teach finances, the driving force behind most of the things happening in our lives, and Bulls and Bears might just be the first step. It’s interesting the Bulls and Bears does this with the ancient art of the board game, pulling kids away from the screens of their tablets and game consoles – perhaps this way they are more likely to engage in discussion with each other and with their parents? In any case, the game also offers a companion app, or a “gamified course,” which provides quick lessons and tips that help players get more out of the game.

But, while that might be the sentiment, the execution might not be the best – this is a game after all, and more depth is needed to understand complex financial structures. The game also doesn’t strike me as very thrilling, so it might have big trouble captivating a younger audience. Couple that with the fact that financial games do exist already – the writer of this article is a Cashflow veteran, and that feels like a solid game that has a pretty big audience already, so what gap is Bulls and Bears filling? Time will tell if this is really a new and different player or just a different take on an existing type of game that fails to capture its audience – although it is encouraging that Bulls and Bears has already garnered some good reviews and awards, including the The National Parenting Center special award.

Fischel himself only wants to help people understand finances better. “After witnessing firsthand how complicated economics can be, I wanted to use my experience to break it down and make it simple and fun to understand for others,” he said. And while the good intentions and maybe even the card mechanics are there, this might be too much education and too little entertainment in the edutainment equation.