8 free apps to track spending and help you save money

We all know what it feels like when your spending is out of control. You don’t remember what you spent on and why. And then somehow before the end of each month, you find yourself eating ramen noodles and ketchup every night to save pennies and make it through the rest month!

It is difficult to earn and easy to spend. Are you one of those who plans on saving but always fails at holding yourself accountable for budgeting and/or sticking to said budget?

Budgeting is something that can be very tiring, cumbersome and daunting for many. But it doesn’t have to be. In reality, budgeting is not a difficult task. In fact, it helps save for the rainy days.

But while saving money is considered to be the most complicated thing, it is anything but. For all those who just can’t budget well, and add it to their resolution for every new year, we have compiled a list of 8 expenditure tracking apps just for you.

Not only are these apps manufactured by reliable software companies like intuz, Appster, and airG, they are also free!

What’s more, the user interface is so simple; anyone can use it without any trouble. Check them out and download any of them right away.

Mint Personal Finance

If you want to keep a close eye on your income and how you spend it, then download Mint Personal Finance now. The app is a life saver for those who are always struggling with savings. Moreover, it allows you to put all your bank and card details in one place. For the lazy souls out there, it sends you a buzzer when you are overdue on bills.

You can directly access your bank account from Mint. Its comprehensive features make it really enjoyable to use. According to your income, it can even suggest how much you should spend on what. But that doesn’t mean you can’t plan your budget.

Dollarbird

If you’ve ever maintained a journal, then using Dollarbird will be the easiest option for you. This free app is a handy tool for those who want to compare their monthly expenses. You are provided with a calendar-style interface to record your spending. The best part is that the timeline mode provides readable infographics instead of text.

The basic budgeting is free, but only premium members can enjoy advanced features. As a premium user, you can share your financial details and expenses charts too. A small business venture or a family can benefit from such features.

Wally

The main purpose of this app is to help you with all your financial needs in one place. The representation of the expenses in a pictorial/graphical form makes it easily readable. You can even set saving and spending goals and work according to them.

Apart from keeping track of your money business, the app allows you to record how much you’ve spent and when. You can maintain a virtual logbook or budget journal by adding photos of your receipts and paid bills. Thus, making it easier for you to recall when you want to compare your monthly or yearly expenditures.

PocketGuard

Do you juggle with lots of credit cards and bank details? If so, PocketGuard provides the easiest solution to your problem.

This one-stop-shop makes financial management a piece of cake for you. Although it connects to all your bank accounts, the app uses the 128-bit SSL encryption for safe account handling. Your account details will not end up in the wrong hands even in case of an unfortunate incident.

PocketGuard manages your bills, subscriptions, and expenses too so you can have a factual statement of your expenditures for each month. It presents a complete picture to you of the amount you can spend.

Fudget

For those who feel too overwhelmed with all the drama and tonnes of graphics, Fudget is for you! This simple budgeting app lets you add your income and expenses with a couple of taps, and that’s about it. You can easily edit your expenses and income as you want. The app also lets you choose your currency.

Techies who do not want to compromise on battery life can download Fudget because this minimalistic app doesn’t consume much.

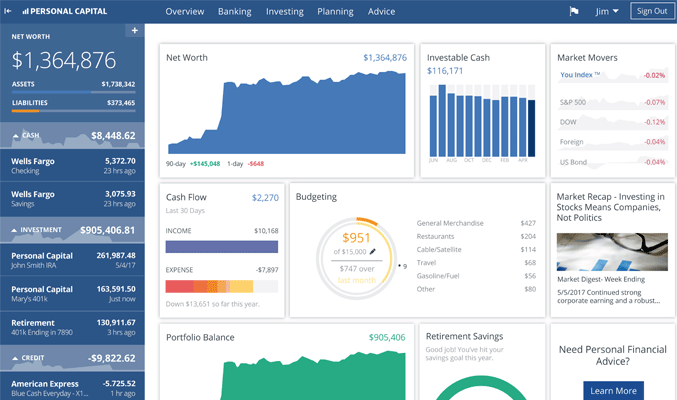

Personal Capital

Like most other budgeting apps, Personal Capital gives you the freedom to sync your accounts. This way, you can easily keep track of your spending. The problem, however, is that you cannot make your own budget. There are some in-app expense categories provided that you can use.

It takes time to get familiar with the app, but in the long run, it is a handy financial tool. But there’s one area this app is excellent in; it can help you grow your investments. The app is equipped with investing tools and lets you monitor S&P 500 and Dow Jones. Plus, it can help you monitor variations in your own shares. The app is considered to be one of the best, and the good thing is that it’s completely free.

Mvelopes

Unlike other apps, Mvelopes uses a budgeting concept that revolves around the envelope budgeting.

This ancient method lets you allot a fixed amount per expense. For example, you can put monthly money for lunches, groceries, and travel. You create envelopes in the app for each expense type and spend accordingly.

This enables users to stay in budget and keep track of expenses on a specifically categorized envelope. You can even get feedback on your expenditures. The app is accessible on both web and mobile phones thus you can sync both apps.

Spendee

Budgeting can be very boring, even intimidating. So why not download Spendee for some learning and fun? The beautifully designed app lets you sync your online bank transactions in one place. This makes it easier to categorize expenses.

Furthermore, you can take pictures of the bills and keep them stored in the app for future reference. The app’s colorful features are not only for vibrancy, but they also let you understand your finances at a glance. Spendee can also help you track your budget when traveling.

Bonus app

Use this free and intuitive college budget template that gives real-time advice based on spending habits (it’s just like having your very own financial advisor), to save money and take control of your finances.

Here’s the template guide which shows you how to use it and get started.

Conclusion

Budgeting means asking yourself some tough questions, such as how can I save for the future? How can I get out of debt? How can I keep what I have?

Spending is an individual habit. Expenses are a result of many individual decisions you take on a daily/monthly basis. It’s never easy to tell someone what they should spend on and how. But you can often get a clear picture of where you’re making bad spending decisions by keeping track of daily expenses.

Did we miss your favorite one? We’d love to hear about it in the comments below!