Slumping ICO market is not deterring eager investors and startups

There are a number of ways to keep up with any financial market. One way is to routinely go through available information, meticulously check different reports, constantly revise your opinion and understand that you might still not fully know what‘s happening. But then again, why bother with reality when you can drop all of that hard work and just follow a pack of “Animal spirits,“ guided by nothing more than shear intuition and high velocity?

The latter is just how most investors now choose to interpret the ICO (Initial Coin Offering) industry, which is a perfect illustration of “Animal spirits” in action – a term that John Maynard Keynes, a renounced British economist coined to explain financial decisions we make in uncertain times and circumstances.

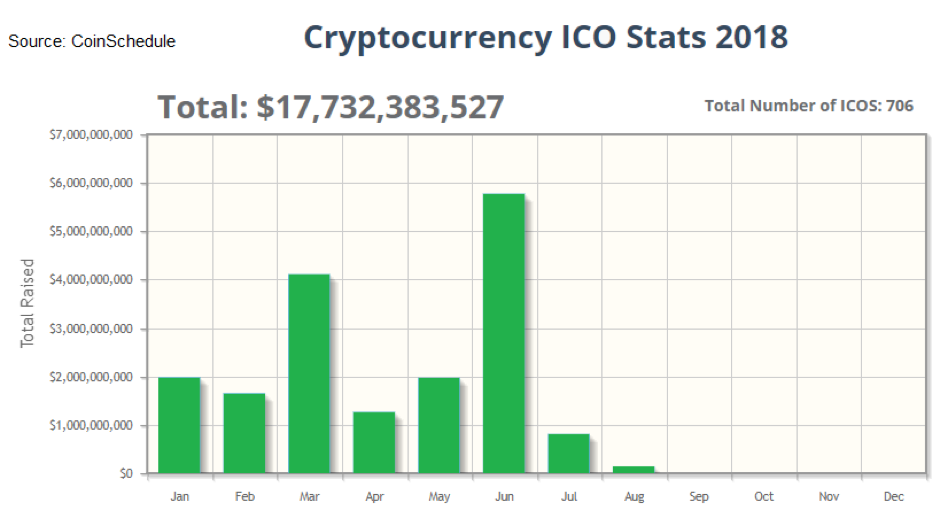

You can call this view cynical, but facts show that July of 2018 hasn‘t been great for the ICO industry. Apart from a bit of reinforcing crypto activity in Malta and Philippines, both Coinspeaker and Zipmex are reporting July as the worst month this year in terms of funds collected by the firms conducting Initial Coin Offerings. Moreover, there‘s also been a slump in the number of firms which achieve the 100% funding goal, not to mention an overall decrease in the numbers of companies which choose to begin an ICO in the first place.

Despite that, many investors seem unfazed. After all, spirits dictate the market: June has been great, that means confidence is high and (by the logic of our rose-tinted view) the sheer positivity will bring growth to the market this August. That is, of course, in spite of the fundamental volatility and uncertainty associated with Initial Coin Offering industry (see graph above).

Food-for-thought

Never mind the stormy times, firms continue to rally investors, who are willing to crowdfund their projects. Despite the overall cynical outlook of this article, your correspondent has to admit there are a few promising beacons of progress floating out there. If you decide to put your money into this galloping market, bet it on these horses.

DxChain

DxChain, the world‘s first decentralized big data and machine learning network, has just closed its token sale on 6th of August having collected over $20m – 95% of its initial goal.

It combines some good ideas that are already in use. A decentralized group of blockchains allows users to use the network both as a data exchange platform to trade their information and as a business intelligence platform to analyze that data for business insights. The system is held together by peer-to-peer network and Hadoop HDFS file systems.

To do this project justice, I invite you to read more about its potential on the proposed whitepaper.

“Don’t spend what you can’t afford to lose” is generally a good rule to go by when it comes to the ICO market.

Ubex

Ubex, a global decentralized advertising exchange, is very close to achieving 100% of its set goal. At the time of writing this, Ubex has already raised over $8.1m and is only $0.8m away from it. There’s also 5 days left of the token sale, so they might get even luckier still.

Their idea is also worth hearing. It has set out to deal with the problems ravaging the advertising industry. With the help of programmatic technologies, neural networks and smart contracts it deems itself capable of dealing with low ad targeting efficiency, non-transparent counter-party relationships and customer dissatisfaction with the quality of advertising.

That is no small feat to accomplish, but if they succeed they will receive a lot of Thank-you (digital) letters from the advertisers, publishers and perhaps even customers alike.

ORCA

Finally, ORCA, an all-in-one platform for personal finances, is one of the newcomers in the ICO industry having just started its token sale on August 6th. It is, however, looking very promising – ORCA already reached early round cap of $1.5m in 50 hours. Second round should start August 27 when ORCA will try to take a stab at the hard cap. While the bears are devouring the market, ORCA seemed to have a chance.

The goal of their project is to create an AI-powered platform from which its token buyers could manage all of their finances on a single interface (crypto included). That means users will have access to different bank accounts and payment cards, to crypto wallets and transaction services, to exchanges, lending services and other financial service providers.

They are, in short, offering a user interface from which you will be able to manage all your cash flows. Their app just might be exactly what most of us surely need in the disorganized world of multiple credit cards, banks accounts and numerous crypto wallets and exchanges.

In summary

“Don’t spend what you can’t afford to lose” is generally a good rule to go by when it comes to the ICO market. It is tempting to engage in a bubble of positivity and imagine yourself as a future rags-to-riches success story, but that is a perfect example of divorcing reality.

June has been great. July has been hard for the many upstarts that were eager to get their feet wet. August also might not be a walk in the park. So, proceed with caution, but if you can’t contain yourself, back one of the most-promising horses.